Feb 21 // Parenting + Growth // Scarcity Mindset, Kids' Balance Sheets, & More!

Here are some tips for reframing our views of money and helping kids manage it wisely!

Hello! Welcome to the new format of Family Scripts! Shorter emails are easier on the eyes and brain 😉 In today’s newsletter, we’re going to talk a lot about reframing our views of money and encouraging our kids to have a healthy view of money. We’ve also got some parenting hacks for you that help you keep track of your kids’ spending without having to use cash.

This email is packed, so let’s get started!

Parenting Pep Talk: Spending Money Well

Challenge Check-In

Parenting Hack: Budgeting for Kids

Another Parenting Hack: Kids’ Balance Sheets

From Our Hearts

Parenting Pep Talk: Spending Money Well

Many of us think that frugality is inherently virtuous. I (Hope) took this to an extreme in the early years of marriage because we were a single-income family making today’s equivalent of $24k a year. We were very happy and our lives felt full, but I was a little obsessed with finding good deals and studied Publix’s BOGO deals religiously. I realized eventually, however, that even though it was good that we were avoiding debt, my commitment to frugality was still causing an unhealthy relationship with money.

I was slipping into a scarcity mindset. I only saw the limits in my resources and I had to keep as much as I could for myself.

When my husband and I started a pressure washing business, we were able to increase our income, and the amazing thing we realized is that we didn’t automatically become greedy. We learned that money isn’t inherently evil, but money is a magnifier. It shows what’s already in someone’s heart.

Many, many people get trapped by money or the pursuit of money—regardless of how much they make. If you are entitled with little, you will still be entitled with much. Always try to live below your means, and if you’re burdened with debt right now, then yes, you might need to be in a season where you have to be frugal and do extra work to get out of it.

However, the amazing thing about money is that you can spend it well. Everyone makes mistakes with how they spend, of course, but it’s powerful once you realize that helping meet another person’s basic money needs frees them up to think about more important things.

You don’t have to be a millionaire to help pay off medical debt (where your donation has 100x impact) or buy someone a used car, but think about how much relief that would cause a person who is consumed by those burdens. As we’ve talked about earlier this month, $40 can provide clean water for one person; clean water not only helps protect people from disease, but it gives them time that they previously spent hauling dirty water. If we can help buy time, safety, and health for other people, that frees them up to think about things like being a better parent, or getting an education, or taking care of their mental health!

Another great thing about money is where it goes when we spend it! We vote with our dollars. (As the Son of Laughter song says, “Every Day is Voting Day.”) When you vote for a political candidate, it feels like no more than a drop in a bucket for a person who might be iffy anyway. But when you spend money well, it makes a personal, tangible, immediate difference.

When you purchase from a small business, you’re validating someone’s dream. You’re rewarding their contribution to society with dollars, good reviews, word-of-mouth marketing, and the satisfaction that their company’s mission is being fulfilled.

Every time you buy from a farmer’s market, you know exactly where your food came from and where that money is going. You’re rewarding a farmer’s commitment to treat the earth and its creatures with care. And—even if some of it is more expensive than a grocery store—locally grown food just tastes better.

When you thrift, you don’t have to worry about the ethics of the company that created that product because your money is usually going to a local business or charity. For example, if you live in Chattanooga and shop at a place like Northside Neighborhood House, that money goes towards several programs that help your neighbors have access to critical services, educational programs, after-school activities, and more. Plus—benefit for you—you just got a J. Crew dress for $6 or a kids’ bike for $5.

When we teach our kids about money, we don’t need to teach them to be scared of money or to feel like they have to pinch every penny. Instead, we can encourage them with these three things:

Challenge Check-In

How did you do with this month’s challenge?

Hearing your stories has been really encouraging! When you get used to saying “no” to yet another impulse buy, your mind feels a bit more freed up, doesn’t it?

Have you found more gratifying ways to use your resources? Reply to this email and let us know what this month’s challenge has been like for you!

For the month of March, the theme we chose is Attentiveness. We dare you to see what form(s) of technology you can take a break from. Some suggestions:

No social media

No Youtube for my kids

No Netflix if I’m by myself

No phone between the hours of 8 pm and 10 am

Those are just some ideas to get you started. Or you could try a combination of any of them! Just make sure you can really commit to it for at least 25 days. This isn’t just a detox but a way to see how you can make long-term changes to be more present and get more out of life.

Parenting Hack: Budgeting for Kids

As your kids start to earn money, one of the most important things you can teach them early on is how to manage it. Many parents think kids shouldn’t get paid for chores because they get to live in the home for free, but giving kids some money is a great opportunity to help them develop key skills for growing up.

Encouraging your kids to start businesses is a great way to help them learn about money, too, and that’s what tomorrow’s newsletter is all about!

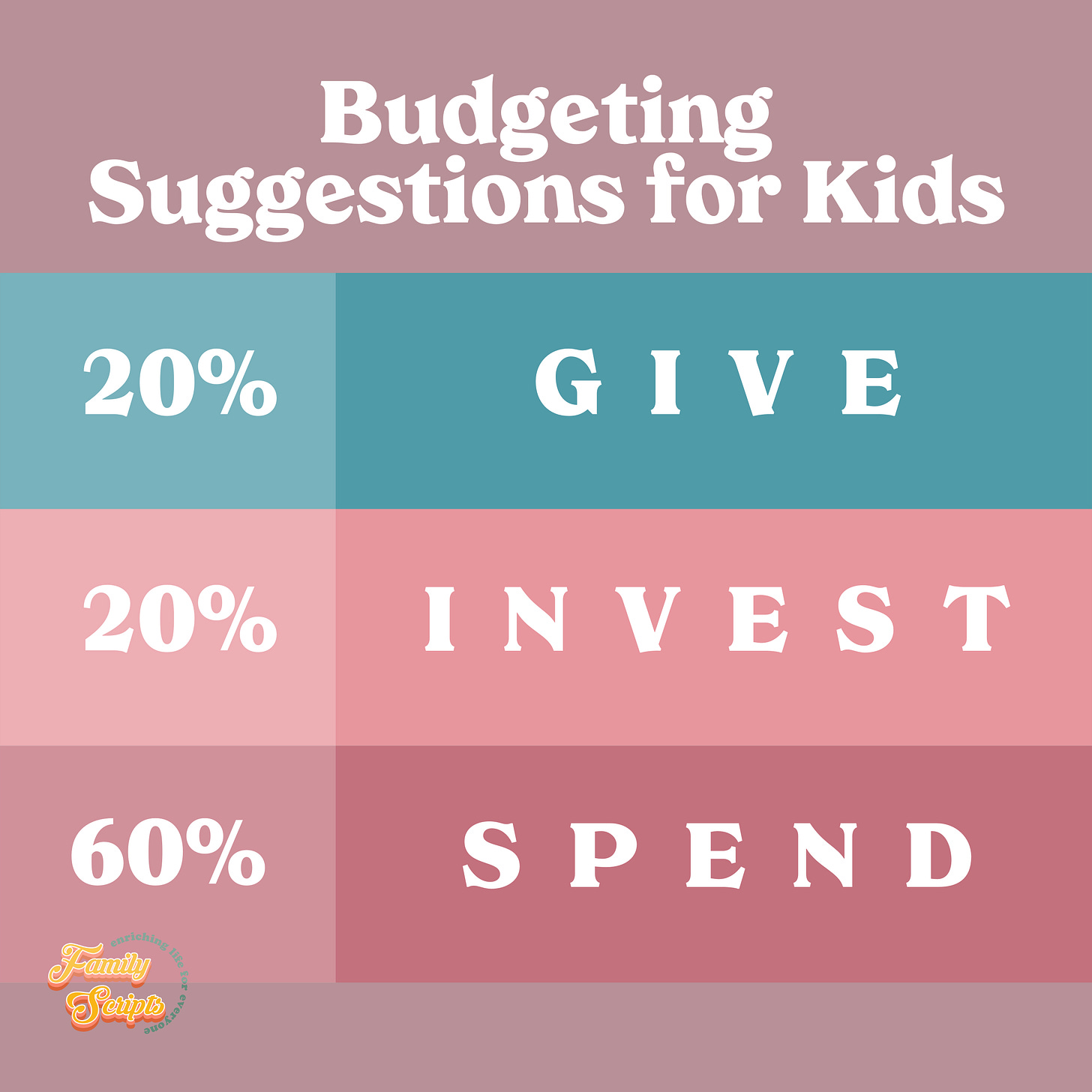

If your kids complete all their chores for the week, you can pay them their age or whatever rate seems right to you. However, that doesn’t mean your 7-year-old should feel entitled to a weekly $7 of spending money. This is a great chance to teach kids how to budget. This is an approximate budget percentage we use in our family:

We make this approximate to keep it as simple as possible and avoid worrying about cents.

For example: for a seven-year-old, their allowance would be $1 give, $1 invest, $5 spend. For a 16-year-old, that would be $3 give, $3 invest, $10 spend.

Here are the categories in more detail:

Give - Keep this money away for giving to church, your favorite charity, or keeping on hand to help someone out.

Invest - Though most lists encourage kids to save, a 5-year-old’s $52 this year will not make a big dent in their college education thirteen years from now…if they even choose that path. Inflation is really bad right now. Instead, you can encourage them to store that money for their entrepreneurial endeavors or even to invest that money in cryptocurrency or index funds using something like the Robinhood app.

P.S. As a grownup, don’t forget about the magic of compounding interest. Investing up to $6000 in your Roth IRA each year is a really smart way to prepare for your future, and the younger you start, the better!

Spend - Letting a kid have some money to spend on whatever they want is fine, and if they’re used to shopping at thrift stores, a few bucks can go a long way. $30 feels like they can buy the whole store. It’s wonderful when we encourage our kids to spend their money on buying gifts for others; they might soon find that it’s happier to give than to receive. It’s also really sweet to see a 7-year-old earn the means to take her friend to ice cream.

Another Parenting Hack: Kids’ Balance Sheets

How do you keep track of money that you're budgeting for your kids?

You probably want to use cash. It’s dirty, it can get lost or ripped by a toddler, and it’s not convenient to acquire.

In an increasingly digital economy, it’s good to teach children how to keep track of their money digitally.

There are different kinds of debit cards for kids and a litany of apps, but if you’re not ready to venture into that world, here’s a simple system we use in our family: we keep track on the Notes app. Simply update the same Note every time your kids gain or spend money.

Here’s what a sample balance sheet might look like ⬇️

So, for example, if you go to Target and Callie buys $5 in craft supplies for her stationery business and an $8 shirt, you simply change her “invest” balance to $2 and her “spend” balance to $5. Then, on allowance day, you can increase her “give” to $2, “invest” to $3, and her “spend” to $10.

Note: If a child receives money for a birthday, you can let that go straight to the spending balance. You don’t need to be too rigid with all this budgeting stuff.

We really don’t want to instill in our kids a scarcity mindset. Instead, we want them to be open-handed and happy to use their resources well, whether that’s buying groceries for a family in need or supporting a small business with a triple scoop of ice cream 😋

From Our Hearts

Money is clearly a big topic that we could dive into much more. Check your inbox tomorrow (Tuesday, Feb 22) for tips on helping your kids run small businesses (even pretend ones) and why it’s worth your time to encourage entrepreneurship when they’re young. Plus, it’s cute.

Here are some things we are praying for you as your family thinks about money:

May your feelings about money not revolve around greed, scarcity, or entitlement, but may you feel great purpose in how you spend the money that you have.

May your kids know that money is not ultimate to you and that you intend to use it well.

May you make wise investments and find awesome ways to meet society’s needs.

May you be open-handed and generous, and may your kids learn from your example.

And may your endeavors prosper!

See you later this week with the new “sections” format! If you need help opting out of part of the newsletter, let us know! You can always reply directly to these emails. Thanks for reading!

Warmly,

Hope from Family Scripts

P.S. Here’s a phone wallpaper!

💕 this! I use balance sheets in the classroom for the kids to learn all of the responsibilities you talked about. They get paid for being there on time daily, also for there jobs, behavior and have may ways to spend it throughout the year.

These are great tips and definitely something I am learning with my kids. Thanks for all the great resources.